|

From Nordic-style skiing to nature hikes, Canada has a smorgasbord of outdoor fun, so it�s

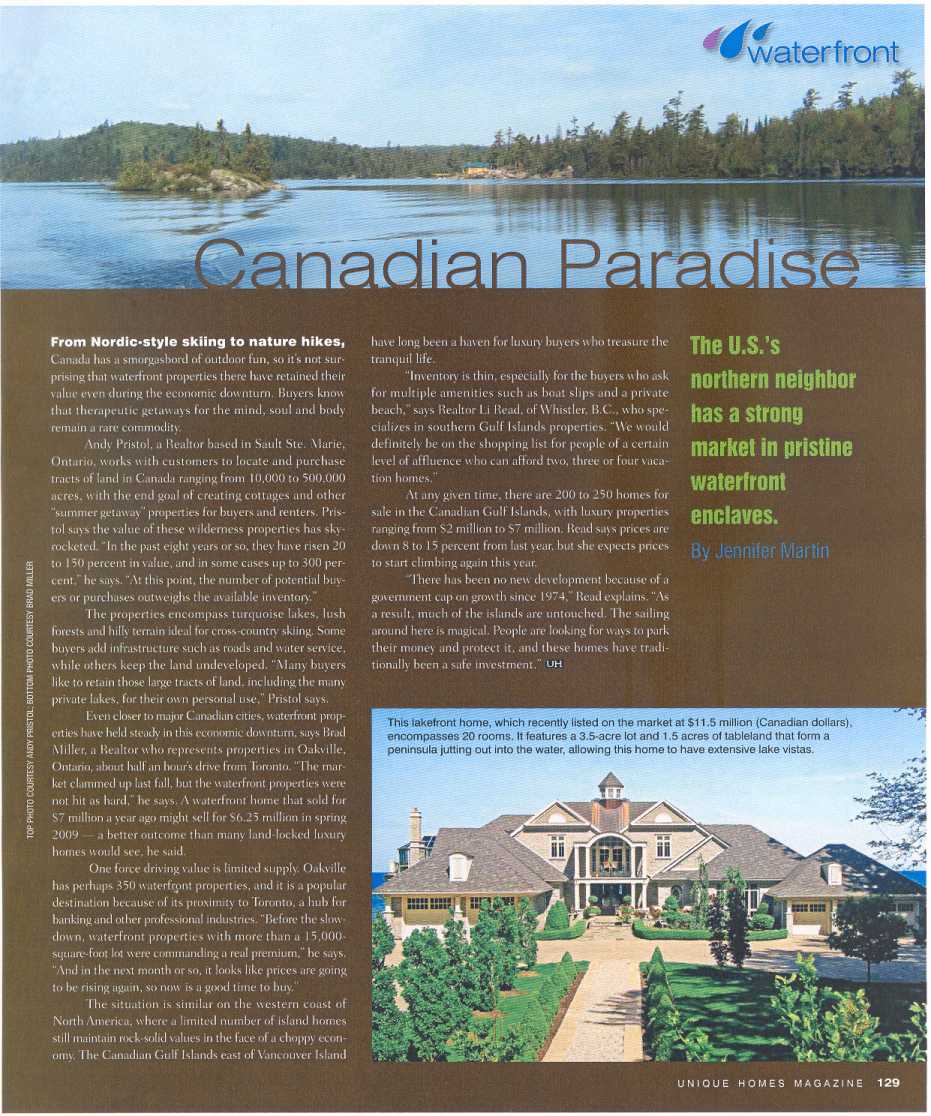

not surprising that waterfront properties there have retained their value even during the

economic downturn. Buyers know that therapeutic getaways for the mind, soul and body

remain a rare commodity. Andy Pristol, a Realtor based in Sault Ste. Marie, Ontario, works with customers to locate and purchase tracts of land in Canada ranging from 10,000 to 500,000 acres, with the end goal of creating cottages and other "summer getaway" properties for buyers and renters. Pristol says the value of these wilderness properties has skyrocketed. "In the past eight years or so, they have risen 20 to 150 percent in value, and in some cases up to 300 percent," he says. "At this point, the number of potential buyers or purchases outweighs the available inventory." The properties encompass turquoise lakes, lush forests and hilly terrain ideal for cross-country skiing. Some buyers add infrastructure such as roads and water service, while others keep the land undeveloped. "Many buyers like to retain those large tracts of land, including the many private lakes, for their own personal use," Pristol says. Even closer to major Canadian cities, waterfront properties have held steady in this economic downturn, says Brad Miller, a Realtor who represents properties in Oakville, Ontario, about half an hour�s drive from Toronto. "The market clammed up last fall, but the waterfront properties were not hit as hard," he says. A waterfront home that sold for $7 million a year ago might sell for $6.25 million in spring 2009 � a better outcome than many land-locked luxury homes would see, he said. One force driving value is limited supply. Oakville has perhaps 350 waterfront properties, and it is a popular destination because of its proximity to Toronto, a hub for banking and other professional industries. "Before the slowdown, waterfront properties with more than a 15,000-square-foot lot were commanding a real premium," he says. "And in the next month or so, it looks like prices are going to be rising again, so now is a good time to buy." The situation is similar on the western coast of North America, where a limited number of island homes still maintain rock-solid values in the face of a choppy economy. The Canadian Gulf Islands east of Vancouver Island have long been a haven for luxury buyers who treasure the tranquil life. "Inventory is thin, especially for the buyers who ask for multiple amenities such as boat slips and a private beach," says Realtor Li Read, of Whistler, B.C., who specializes in southern Gulf Islands properties. "We would definitely be on the shopping list for people of a certain level of affluence who can afford two, three or four vacation homes." At any given time, there are 200 to 250 homes for sale in the Canadian Gulf Islands, with luxury properties ranging from $2 million to $7 million. Read says prices are down 8 to 15 percent from last year, but she expects prices to start climbing again this year. "There has been no new development because of a government cap on growth since 1974," Read explains. "As a result, much of the islands are untouched. The sailing around here is magical. People are looking for ways to park their money and protect it, and these homes have traditionally been a safe investment." |